free cash flow yield private equity

The trailing FCF yield for the SP 500 rose from 11 on 33121 to 22. Free Cash Flow Yield Free Cash Flow Market Capitalization This ratio expresses the percentage of money left over for shareholders.

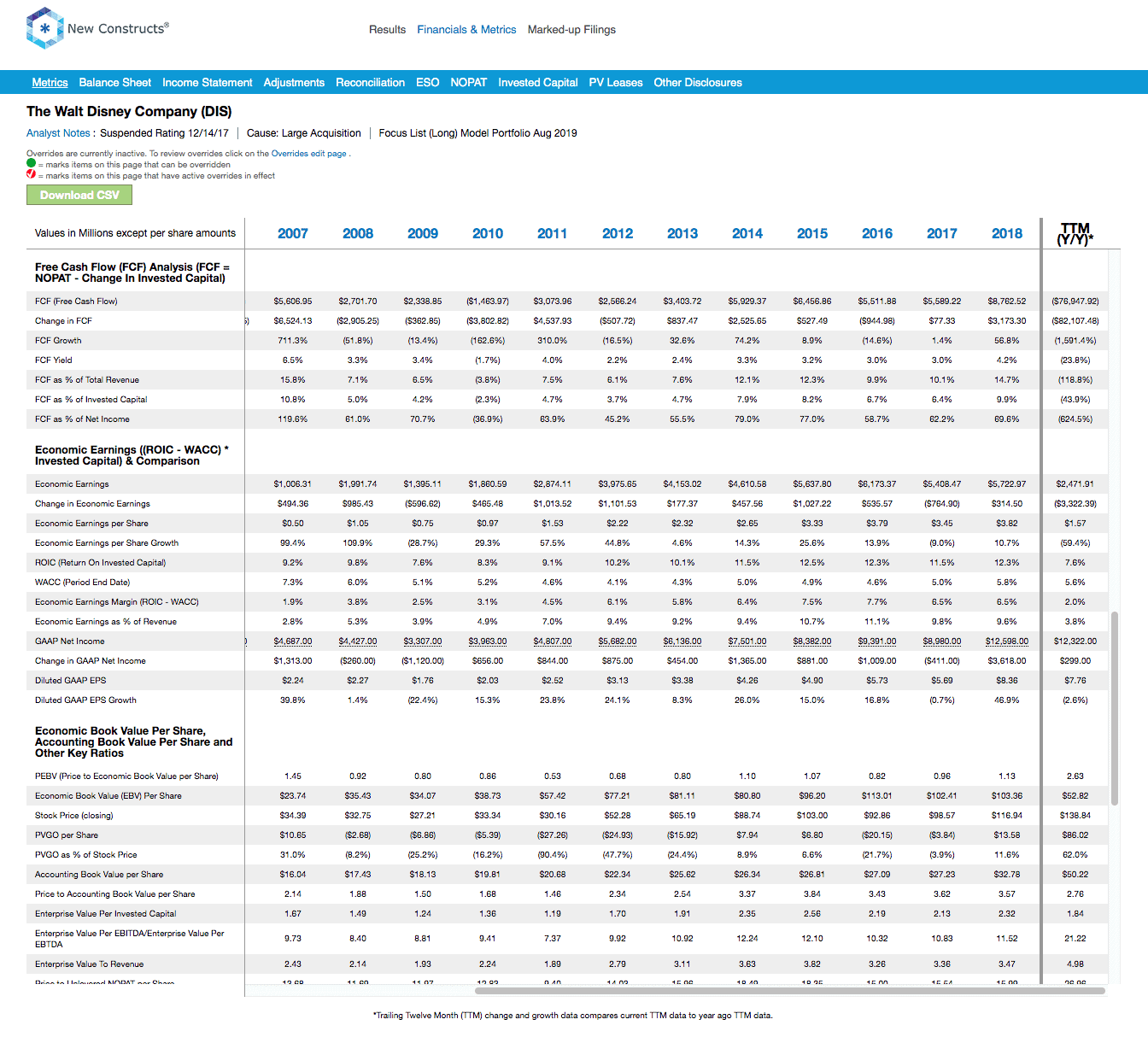

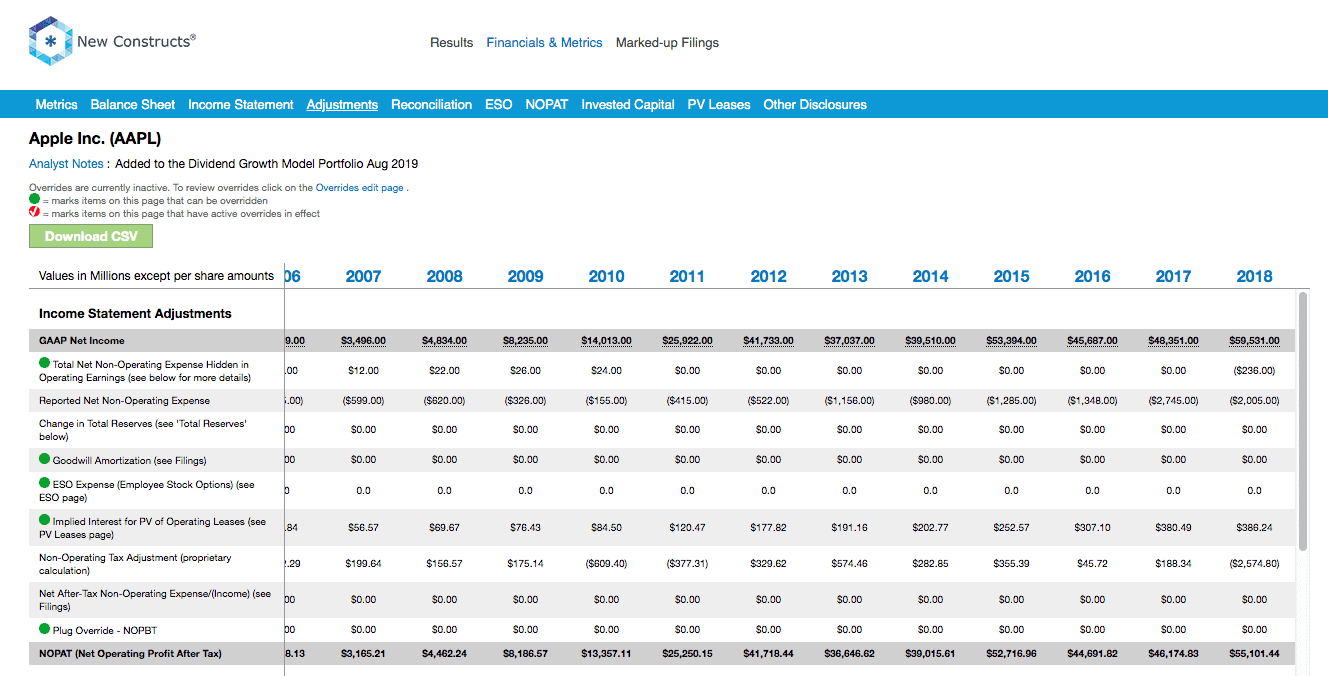

Free Cash Flow And Fcf Yield New Constructs

Since CVR has a market value of 356 billion CVR stock has an FCF yield of 171.

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

. A free cash flow yield of over 10 per cent is considered to be high. In corporate finance free cash flow to equity FCFE is a metric of how much cash can be distributed to the equity shareholders of the company as dividends or stock buybacks after all expenses reinvestments and debt repayments are taken care of. Yields above 7 would be considered of high rank.

Cash flows rose faster than stock prices as the indexs free cash flow FCF yield rose to its highest level since 123118. Dividing the total value of equity by the number of outstanding shares gives the value per share. Free cash flow yield is a financial solvency ratio that compares the free cash flow per share a company is expected to earn against its market value per share.

With the FCFE valuation approach the value of equity can be found by discounting FCFE at the required rate of return on equity r. The current price of the stock multiplied by the total number of shares available. Get 27 financial modeling templates in swipe file.

This is because the free cash flow can be used to support the large amounts of debt that private equity buyers tend to use to finance their takeovers. The ratio is calculated by taking the. It is also referred to as the levered free cash flow or the flow to equity FTE.

To break it down free cash flow yield is determined first by using a companys cash flow statement subtracting capital expenditures from all cash flow operations. Using that example your Cash Yield is 10 500050000. COWZs free cash flow yield of 4 is double IUSV and SPY at 2.

Free cash flow yield is meant to show investors how much free cash flow a company generates relative to the value of its sources of funds. Then the free cash flow value is divided by the companys value or market cap. CVRs dividend cost 301 million in the past year.

Free cash flow yield is really just the companys free cash flow divided by its market value. The price to economic book value PEBV ratio for COWZ is 14 which is less than the 18 for IUSV holdings and nearly half the 26. Free Cash Flow Yield determines if the stock price provides good value for the amount of free cash flow being generated.

The net property investment is usually the down payment which is the propertys cost minus the amount you borrowed. Equity value t1 FCFEt 1rt. Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling DCF MA LBO Comps and Excel Modeling.

Suppose you bought a property and your net cash flow was 5000 and the cash invested in your property was 50000. LFCF yield LFCF Value of equity. Equity value t 1 FCFE t 1 r t.

To calculate the free cash flow yield of a stock you need to know how much it would cost you to buy the entire company right now market capitalization. Whats left is often called free cash flow which is then available to be used perhaps to pay a dividend or expand the businessTo turn this into an equity free cash-flow yield you divide it by. If the company has 10 shares available at 1000 apiece the market capitalization is 10000.

LFCF yield measures LFCF against the value of equity while UFCF yield measures UFCF against enterprise value. In depth view into Equity Residential Free Cash Flow Yield including historical data from 1993 charts stats and industry comps. High free cash flow yield shares are sometimes seen as possible takeover targets for private equity groups.

In general especially when researching dividend stocks yields above 4 would be acceptable for further research.

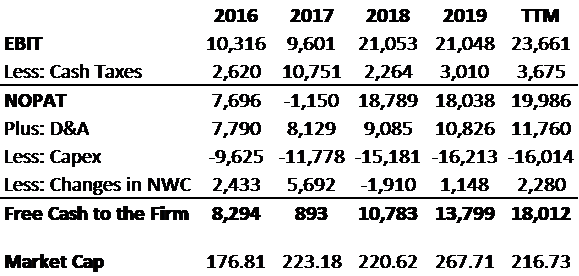

Free Cash Flow To Firm Fcff Unlevered Fcf Formula And Excel Calculator

Fcf Yield Unlevered Vs Levered Formula And Calculator

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Free Cash Flow Yield Formula Top Example Fcfy Calculation

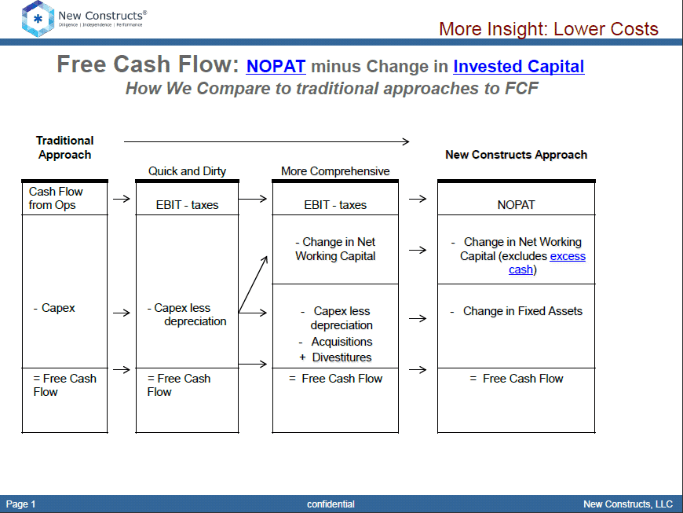

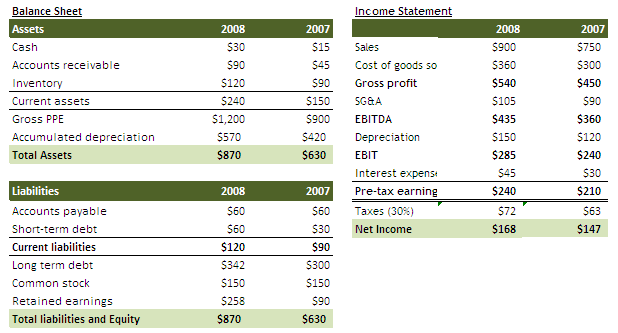

Free Cash Flow From Ebitda Calculation Of Fcff Fcfe From Ebitda

Fcf Yield Unlevered Vs Levered Formula And Calculator

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Fcf Yield Unlevered Vs Levered Formula And Calculator

Free Cash Flow Meaning Examples What Is Fcf In Valuation

Fcf Yield Unlevered Vs Levered Formula And Calculator

Free Cash Flow Yield Explained

Free Cash Flow And Fcf Yield New Constructs

Free Cash Flow Yield Finding Gushing Cash Flow For Future Growth

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator